1994

Well ahead of most of the industry, founders Peter Johnson and Judy Kirst-Kolkman recognize the promise and value in emerging markets, create Developing World Markets as a hedge fund manager, and begin making credit and equity investments. They collaborate with former Citibank Chief Economist Leif Olsen to develop a rigorous and specific emerging markets investment methodology.

1996

Peter and Judy offer volunteer support for Pro Mujer International, the then nascent, women-focused microfinance and healthcare network. With Peter on the board and, later, board chair, this work provided clear visibility to DWM that in Latin America, as in South Asia with Muhammad Yunus’s Grameen Bank, very low-income clients, especially women, repay microloans with very high reliability—the foundation for a number of DWM’s investment vehicles to come.

1998

DWM establishes the world’s first emerging markets IPO fund, aiming to obtain pre-listing stakes in small and medium-sized enterprises. The fund would ultimately invest in 20 countries across Africa, Asia, emerging Europe, and the Middle East and participate in more than 350 initial public offerings on local stock exchanges.

1999

DWM makes a meaningful donation to Pro Mujer International to help promote Pro Mujer’s work in inclusive finance, healthcare access and gender empowerment for very-low-income Latin American women. To give the donation the rigor and staying power of an endowment, DWM partners with Pro Mujer to create the Pro Mujer Loan Fund, enabling Pro Mujer to support its microfinance institutions (MFIs) at reasonable cost.

2004

DWM structures and raises the first cross-border microfinance collateralized loan obligation, partnering with BlueOrchard to channel $87 million to 14 microfinance institutions (MFIs). This was the first time loans to MFIs all made and maturing on the same date were pooled into a diversified portfolio backing the issuance of notes. This application of a long-practiced concept in debt markets was a breakthrough in demonstrating the investability of microfinance and the practicality of impact investing.

2006

A DWM collateralized loan obligation is the first microfinance instrument to receive a rating by a third-party risk assessment firm. Encompassing $60 million for loans to 26 MFIs in 17 countries, this milestone in impact investing is a DWM breakthrough that helps clear the way for the entry of institutional investors that require ratings—ultimately benefiting developing economies and communities.

DWM arranges a $43 million private equity investment by TIAA-CREF (now TIAA) into ProCredit Holdings, a network of banks operating in developing countries and serving small- and medium-sized enterprises and low-income individuals. This equity capital raise, one of the largest to that date in inclusive finance, shined a light on impact investing by bringing in a high-profile institutional investor—and helped DWM see the potential for private equity in inclusive finance to complement our lending.

2007

DWM structures the first international bond issuance out of Azerbaijan, a $25 million loan to Microfinance Bank of Azerbaijan (now AccessBank).

DWM partners with SNS Asset Management (now ACTIAM) to create the ACTIAM Institutional Microfinance Fund I to lend to microfinance institutions across Latin America, Eastern Europe, Asia, and Africa. DWM serves as investment manager and ACTIAM as fund manager. The fund grows to approximately $250 million.*

2008

DWM and ACTIAM partner to launch the second institutional microfinance fund for Dutch institutional investors, which grows to approximately $260 million. DWM serves as the investment manager.

DWM wins the Fast Company Social Capitalist Award as one of 10 “profits with purpose” selected for their “rigorous methodology.”

2009

DWM launches its first dedicated microfinance private equity fund, the DWM Microfinance Equity Fund I. The Fund closed with $82 million in commitments from four institutional investors, including two of the world’s largest pension schemes: Netherlands-based APG and New York-based TIAA-CREF.*

DWM becomes an early signatory to UNPRI, a rigorous framework for incorporating environmental, social, and corporate governance (ESG) issues into investing.

2010

DWM begins encouraging portfolio institutions to submit annual social performance standards reports to the Microfinance Information Exchange (MIX) Market and to acquire social ratings. This is a natural outgrowth of DWM’s commitment to ongoing and transparent impact metrics.

2011

DWM becomes an original signer of the Principles for Investing in Inclusive Finance sponsored by Queen Maxima of the Netherlands in her role as Special Advocate for Inclusive Finance for the UN Secretary-General.

DWM partners with Daiwa Securities and Tokio Marine Asset Management to create the Daiwa Microfinance Fund, which raises more than JPY19 billion in the Japanese retail market. This innovative fund offers daily liquidity via a portfolio of both private loans to microfinance institutions and listed “supranational” bonds of development finance institutions such as the IFC and EBRD.†

DWM is named one of the ImpactAssets 50 impact investment managers globally.

DWM becomes an original signer of the Principles for Investing in Inclusive Finance sponsored by Queen Maxima of the Netherlands in her role as Special Advocate for Inclusive Finance for the UN Secretary-General.

DWM partners with Daiwa Securities and Tokio Marine Asset Management to create the Daiwa Microfinance Fund, which raises more than JPY19 billion in the Japanese retail market. This innovative fund offers daily liquidity via a portfolio of both private loans to microfinance institutions and listed “supranational” bonds of development finance institutions such as the IFC and EBRD.†

DWM is named one of the ImpactAssets 50 impact investment managers globally.

2012

DWM is a pioneer participant in GIIRS, the Global Impact Investing Ratings System, a comprehensive and transparent system for analyzing and rating the social and environmental impact of companies and funds.

DWM is named to the ImpactAssets 50 list of global impact asset managers for the second year in a row.

2013

DWM is again named to the ImpactAssets 50 list of global impact asset managers.

2014

The DWM-advised ACTIAM Institutional Microfinance Fund III raises $115 million for loans to microfinance institutions, with DWM as the investment manager.†

2015

DWM surpasses $1 billion in self-originated loans to inclusive financial institutions.

DWM launches the Inclusive Finance Private Equity Fund II, raising $52 million. Widening substantially the investor base from our first PE fund, DWM receives commitments from pension funds, development finance institutions, high-net-worth individuals and family offices. The fund sharpened DWM’s focus for inclusive finance equity investments across Asia and Latin America and expanded the scope of our equity investments to cover microfinance institutions, banks serving low-income and MSME (micro, small and medium enterprise) clients and specialty lenders in housing and energy.

2016

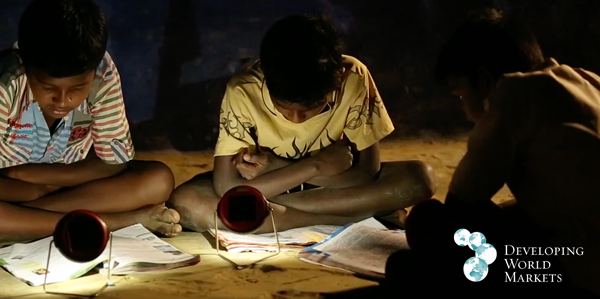

The DWM Off-Grid, Renewable and Climate Action (“ORCA”) Impact Note lends $60.8 million to emerging and frontier market companies for off-grid solar and climate action, helping to address the needs of the more than 2.2 billion people living without reliable electricity access.

DWM partners with SBI Securities to create a bond issue† backed by loans to MFIs, a first for Japanese investors and one of very few impact investment vehicles created in Japan since DWM’s Daiwa Microfinance Fund partnership in 2011.

DWM is appointed as an advisor by Invest in Visions GmbH to originate and sub-manage assets for the largest microfinance fund in Germany, their IIV Mikrofinanzfonds.†

ImpactAssets names DWM to the ImpactAssets 50 list of impact fund managers globally.

The DWM Off-Grid, Renewable and Climate Action (“ORCA”) Impact Note lends $60.8 million to emerging and frontier market companies for off-grid solar and climate action, helping to address the needs of the more than 2.2 billion people living without reliable electricity access.

DWM partners with SBI Securities to create a bond issue† backed by loans to MFIs, a first for Japanese investors and one of very few impact investment vehicles created in Japan since DWM’s Daiwa Microfinance Fund partnership in 2011.

DWM is appointed as an advisor by Invest in Visions GmbH to originate and sub-manage assets for the largest microfinance fund in Germany, their IIV Mikrofinanzfonds.†

ImpactAssets names DWM to the ImpactAssets 50 list of impact fund managers globally.

2017

DWM becomes sole advisor for Invest in Visions’ new DKM Mikrofinanzfonds,† originating and sub managing the assets.

2018

DWM partners with Monega KAGmbH to launch a multi-thematic impact private credit fund, Monega Multi-Sector Microfinance & Impact Loans Fund,† with DWM as fund manager and supported by key German institutional investors aligned with DWM’s impact and return goals.

2019

DWM and Monega partner again to launch a multi-thematic impact mutual fund for the German market, the Monega Mikrofinanz & Impact Fonds, with DWM as fund manager.† This is only the second mutual fund to be launched under specific German financial regulations that support microfinance as an investable asset.

DWM is named to the ImpactAssets 50 annual list of global impact fund managers.

DWM and Monega partner again to launch a multi-thematic impact mutual fund for the German market, the Monega Mikrofinanz & Impact Fonds, with DWM as fund manager.† This is only the second mutual fund to be launched under specific German financial regulations that support microfinance as an investable asset.

DWM is named to the ImpactAssets 50 annual list of global impact fund managers.

2020

DWM surpasses $2 billion in DWM-originated loans and private equity investments to inclusive financial institutions.

During the COVID pandemic, DWM launches a $100 million SDG-aligned impact investment strategy backed by Nordic institutional investors channeling needed credit to an initial 18 companies in 14 countries and 13 currencies actively contributing to the UN’s Sustainable Development Goals.

DWM is named to the ImpactAssets 50 annual list of global impact fund managers.

DWM partners with Trill Impact, an affiliate of Nordea Asset Management, to promote emerging- and frontier-market impact private credit strategies among Nordic investors.

DWM becomes a signatory to the Operating Principles for Impact Management (OPIM).

2021

DWM is named to the ImpactAssets 50 list of impact fund managers globally for the seventh time in the program’s 10-year history.

DWM becomes a signatory to the Net Zero Asset Managers Initiative.

DWM releases an independent impact verification, the first of planned annual releases, as part of our participation in the Operating Principles for Impact Management (OPIM). The independent auditor, Innovest Advisory, reports that “The overwhelming takeaway from our review of DWM’s policies and procedures...is how deeply embedded the achievement of impact is within the DWM investment philosophy and processes...throughout the firm.”

2022

DWM surpasses $2.5 billion in DWM-originated loans and private equity investments to inclusive financial institutions.

2023

DWM is named to the ImpactAssets 50 list of impact managers globally for the ninth time and for the fifth consecutive year.

2024

DWM’s SDG-aligned impact investment strategy backed by Nordic institutional investors reaches $250 million AUM.

DWM earns a place on BlueMark’s 2024 Practice Leaderboard, reflecting top-quartile ratings of alignment with impact principles.

*This fund is closed to investors

†Not available to US investors